Established 2005 Registered Charity No. 1110656

Scottish Charity Register No. SC043760

DONATE

RECENT TWEETS

New rules could soon make it easier for homeless people or those on low incomes to open a bank account.

Access to banking services should be a legal right, according to the EU Parliament, which is calling for legislation to bring slacking banks into line.

It says that 10 per cent of EU citizens still struggle without a bank account, including homeless people, those on very low incomes, students, people with no credit record and foreign workers.

European MPs, who argue that the “soft approach” is not working, are calling for new rules that will force all banks across the European Union to offer basic services. When similar calls were made last year, the parliament said that of the 30 million “unbanked” citizens, between six and seven million had been denied access to a bank account.

Bob Baker, director at The Simon Community, pointed out that although the unbanked might struggle to open an account once homeless, for the vast majority, homelessness is a temporary situation and many already hold a bank account.

But Balbir Chatrik, director of policy and participation at youth homelessness charity Centrepoint, added that the situation could potentially get worse. “Limited access to mainstream banking services remains a significant problem for homeless young people,” she said. “Many young people get turned down for bank accounts because they cannot provide the necessary identification documents. This is likely to pose an increasing problem, as the scrapping of benefits cheques will make it harder for those without a bank account to receive benefits.”

While the issue of universal banking is an ongoing problem, with banks inclined to favour “commercially attractive” customers, some progress has been made - especially in the UK, according to the British Banking Authority (BBA).

Brian Capon of the BBA explained: “In the 1990s banks in the UK worked with the government to make banking as accessible as possible through the Universal Banking initiative that promoted financial inclusion.

“At the start of the initiative there were around three million people who did not have a bank account and this has since been reduced to around one million.”

Today, all major high street banks offer basic banking services and there are now around 8.5 million such accounts, with almost all offering access at Post Office counters. Generally, only those with a history of fraud will be turned away, though many banks will also decline applications made by undischarged bankrupts, added Capon.

Despite the progress, the EU Parliament wants banks to go further, offering more and better services for basic account holders - including a small overdraft facility - while also making it easier for current account holders to switch to a free basic account.

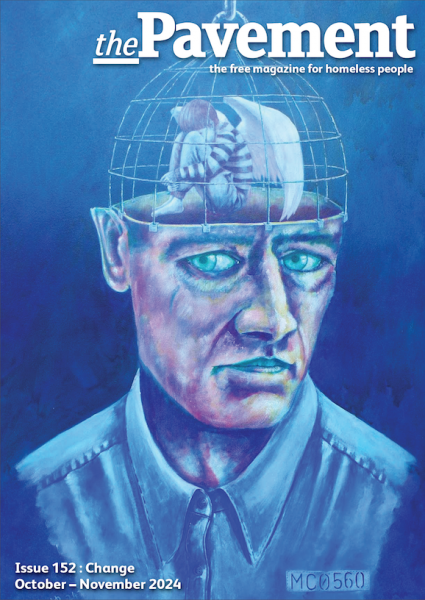

October – November 2024 : Change

CONTENTS

BACK ISSUES

- Issue 152 : October – November 2024 : Change

- Issue 151 : August – September 2024 : Being Heard

- Issue 150 : June – July 2024 : Reflections

- Issue 149 : April – May 2024 : Compassion

- Issue 148 : February – March 2024 : The little things

- Issue 147 : December 2023 – January 2024 : Next steps

- Issue 146 : October 2023 – November 2023 : Kind acts

- Issue 145 : August 2023 – September 2023 : Mental health

- Issue 144 : June 2023 – July 2023 : Community

- Issue 143 : April 2023 - May 2023 : Hope springs

- Issue 142 : February 2023 - March 2023 : New Beginnings

- Issue 141 : December 2022 - January 2023 : Winter Homeless

- Issue 140 : October - November 2022 : Resolve

- Issue 139 : August - September 2022 : Creativity

- Issue 138 : June - July 2022 : Practical advice

- Issue 137 : April - May 2022 : Connection

- Issue 136 : February - March 2022 : RESPECT

- Issue 135 : Dec 2021 - Jan 2022 : OPPORTUNITY

- Issue 134 : September-October 2021 : Losses and gains

- Issue 133 : July-August 2021 : Know Your Rights

- Issue 132 : May-June 2021 : Access to Healthcare

- Issue 131 : Mar-Apr 2021 : SOLUTIONS

- Issue 130 : Jan-Feb 2021 : CHANGE

- Issue 129 : Nov-Dec 2020 : UNBELIEVABLE

- Issue 128 : Sep-Oct 2020 : COPING

- Issue 127 : Jul-Aug 2020 : HOPE

- Issue 126 : Health & Wellbeing in a Crisis

- Issue 125 : Mar-Apr 2020 : MOVING ON

- Issue 124 : Jan-Feb 2020 : STREET FOOD

- Issue 123 : Nov-Dec 2019 : HOSTELS

- Issue 122 : Sep 2019 : DEATH ON THE STREETS

- Issue 121 : July-Aug 2019 : INVISIBLE YOUTH

- Issue 120 : May-June 2019 : RECOVERY

- Issue 119 : Mar-Apr 2019 : WELLBEING

- Issue 118 : Jan-Feb 2019 : WORKING HOMELESS

- Issue 117 : Nov-Dec 2018 : HER STORY

- Issue 116 : Sept-Oct 2018 : TOILET TALK

- Issue 115 : July-Aug 2018 : HIDDEN HOMELESS

- Issue 114 : May-Jun 2018 : REBUILD YOUR LIFE

- Issue 113 : Mar–Apr 2018 : REMEMBRANCE

- Issue 112 : Jan-Feb 2018

- Issue 111 : Nov-Dec 2017

- Issue 110 : Sept-Oct 2017

- Issue 109 : July-Aug 2017

- Issue 108 : Apr-May 2017

- Issue 107 : Feb-Mar 2017

- Issue 106 : Dec 2016 - Jan 2017

- Issue 105 : Oct-Nov 2016

- Issue 104 : Aug-Sept 2016

- Issue 103 : May-June 2016

- Issue 102 : Mar-Apr 2016

- Issue 101 : Jan-Feb 2016

- Issue 100 : Nov-Dec 2015

- Issue 99 : Sept-Oct 2015

- Issue 98 : July-Aug 2015

- Issue 97 : May-Jun 2015

- Issue 96 : April 2015 [Mini Issue]

- Issue 95 : March 2015

- Issue 94 : February 2015

- Issue 93 : December 2014

- Issue 92 : November 2014

- Issue 91 : October 2014

- Issue 90 : September 2014

- Issue 89 : July 2014

- Issue 88 : June 2014

- Issue 87 : May 2014

- Issue 86 : April 2014

- Issue 85 : March 2014

- Issue 84 : February 2014

- Issue 83 : December 2013

- Issue 82 : November 2013

- Issue 81 : October 2013

- Issue 80 : September 2013

- Issue 79 : June 2013

- Issue 78 : 78

- Issue 77 : 77

- Issue 76 : 76

- Issue 75 : 75

- Issue 74 : 74

- Issue 73 : 73

- Issue 72 : 72

- Issue 71 : 71

- Issue 70 : 70

- Issue 69 : 69

- Issue 68 : 68

- Issue 67 : 67

- Issue 66 : 66

- Issue 65 : 65

- Issue 64 : 64

- Issue 63 : 63

- Issue 62 : 62

- Issue 61 : 61

- Issue 60 : 60

- Issue 59 : 59

- Issue 58 : 58

- Issue 57 : 57

- Issue 56 : 56

- Issue 56 : 56

- Issue 55 : 55

- Issue 54 : 54

- Issue 53 : 53

- Issue 52 : 52

- Issue 51 : 51

- Issue 50 : 50

- Issue 49 : 49

- Issue 48 : 48

- Issue 47 : 47

- Issue 46 : 46

- Issue 45 : 45

- Issue 44 : 44

- Issue 43 : 43

- Issue 42 : 42

- Issue 5 : 05

- Issue 4 : 04

- Issue 2 : 02

- Issue 1 : 01

- Issue 41 : 41

- Issue 40 : 40

- Issue 39 : 39

- Issue 38 : 38

- Issue 37 : 37

- Issue 36 : 36

- Issue 35 : 35

- Issue 34 : 34

- Issue 33 : 33

- Issue 10 : 10

- Issue 9 : 09

- Issue 6 : 06

- Issue 3 : 03

- Issue 32 : 32

- Issue 31 : 31

- Issue 30 : 30

- Issue 29 : 29

- Issue 11 : 11

- Issue 12 : 12

- Issue 13 : 13

- Issue 14 : 14

- Issue 15 : 15

- Issue 16 : 16

- Issue 17 : 17

- Issue 18 : 18

- Issue 19 : 19

- Issue 20 : 20

- Issue 21 : 21

- Issue 22 : 22

- Issue 23 : 23

- Issue 24 : 24

- Issue 25 : 25

- Issue 8 : 08

- Issue 7 : 07

- Issue 26 : 26

- Issue 27 : 27

- Issue 28 : 28

- Issue 1 : 01