Established 2005 Registered Charity No. 1110656

Scottish Charity Register No. SC043760

DONATE

RECENT TWEETS

Having a bank account can be pretty handy. Our writer takes

a look at a scheme run by HSBC for people experiencing

homelessness to open a bank account – and also provides some

standard tips on bank accounts. By Liat Fainman

A bank account can provide a safe and secure space for you to store whatever cash you have on hand. You will still be able to access it anytime you wish, but you eliminate the risk of having it stolen or lost while on the streets or in temporary housing. Having a bank account also lays the foundation for financial stability in other aspects of your life. For example, a lot of jobs or benefit schemes will need your bank details in order to transfer your weekly or monthly earnings and renters typically prefer, if not require, direct payments from your bank account. Finally, as you continue to progress towards independence, your bank account will serve as a useful tool to prove your identity and financial history, which can eventually help you borrow money in the future. If those sound like good reasons, then you can use the following information to help you open your first (or next) bank account.

In terms of banks, HSBC has a special service specifically for the homeless called No Fixed Address. This initiative allows people living on the streets or with impermanent homes to open a bank account. In order to to get started, you will first need to get in touch with a local charity specialising in homelessness. There are hundreds of partners across the UK. Examples of Londonbased charities include: Centrepoint, LookAhead, SaferLondon, Crisis, and The Salvation Army. Once you have contacted the charity, you will need to fill out a brief referral form to clarify your situation. Following that, the charity partner will arrange an appointment at your local HSBC to open an account. Finally, after your appointment, HSBC will send your banking information and bank card directly to the charity for you to pick up.

Once you have an account, what are some basics you should know? Let us start off with some helpful vocabulary. There are two different types of accounts you can set up – a current account and a savings account. A current account is where you put money you use every day to pay for necessities like groceries or rent, whereas a savings account is where you store money that you do not need straight away. When you keep money in a savings account, the bank will reward you with small amounts of additional money called interest. For example, if you keep £100 in your savings account for the year, the bank would pay you around 0.05% on top of that, meaning you would end with £105. So, the more money you keep in your savings account, the more money you will earn. On the other hand, if you decide to borrow money from the bank, then you will owe them interest in addition to the original amount you borrowed. Because of this, it is very important that you only borrow money when you absolutely need to and have a plan in place to pay the bank back. Your HSBC branch will be able to give you one-on-one guidance as to borrowing best practices.

The last piece of critical information to know is how to put in and take money out of your account. To do this, you will need two things: your bank card and your PIN number. Your bank card will be delivered to your charity partner as the final step in setting up your bank account. It will be a physical card, called a debit card, with your name on it. Your PIN number is a secret four-digit number combination you will decide on when you have your appointment with HSBC. To store money in your account, you can go to any bank branch or HSBC ATM located in your area, insert your bank card, enter your PIN number, and insert cash in the machine. To take out cash, you will once again find a branch or ATM, insert your card, select the “withdraw” option, and choose the amount you want. You can only take out as much money as you have in your account. For more information, reach out to your charity partner or HSBC. With that, you will be taking your first steps towards better managing your finances.

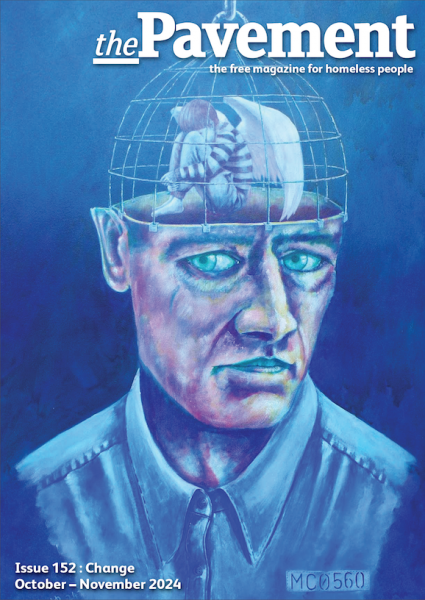

October – November 2024 : Change

CONTENTS

BACK ISSUES

- Issue 152 : October – November 2024 : Change

- Issue 151 : August – September 2024 : Being Heard

- Issue 150 : June – July 2024 : Reflections

- Issue 149 : April – May 2024 : Compassion

- Issue 148 : February – March 2024 : The little things

- Issue 147 : December 2023 – January 2024 : Next steps

- Issue 146 : October 2023 – November 2023 : Kind acts

- Issue 145 : August 2023 – September 2023 : Mental health

- Issue 144 : June 2023 – July 2023 : Community

- Issue 143 : April 2023 - May 2023 : Hope springs

- Issue 142 : February 2023 - March 2023 : New Beginnings

- Issue 141 : December 2022 - January 2023 : Winter Homeless

- Issue 140 : October - November 2022 : Resolve

- Issue 139 : August - September 2022 : Creativity

- Issue 138 : June - July 2022 : Practical advice

- Issue 137 : April - May 2022 : Connection

- Issue 136 : February - March 2022 : RESPECT

- Issue 135 : Dec 2021 - Jan 2022 : OPPORTUNITY

- Issue 134 : September-October 2021 : Losses and gains

- Issue 133 : July-August 2021 : Know Your Rights

- Issue 132 : May-June 2021 : Access to Healthcare

- Issue 131 : Mar-Apr 2021 : SOLUTIONS

- Issue 130 : Jan-Feb 2021 : CHANGE

- Issue 129 : Nov-Dec 2020 : UNBELIEVABLE

- Issue 128 : Sep-Oct 2020 : COPING

- Issue 127 : Jul-Aug 2020 : HOPE

- Issue 126 : Health & Wellbeing in a Crisis

- Issue 125 : Mar-Apr 2020 : MOVING ON

- Issue 124 : Jan-Feb 2020 : STREET FOOD

- Issue 123 : Nov-Dec 2019 : HOSTELS

- Issue 122 : Sep 2019 : DEATH ON THE STREETS

- Issue 121 : July-Aug 2019 : INVISIBLE YOUTH

- Issue 120 : May-June 2019 : RECOVERY

- Issue 119 : Mar-Apr 2019 : WELLBEING

- Issue 118 : Jan-Feb 2019 : WORKING HOMELESS

- Issue 117 : Nov-Dec 2018 : HER STORY

- Issue 116 : Sept-Oct 2018 : TOILET TALK

- Issue 115 : July-Aug 2018 : HIDDEN HOMELESS

- Issue 114 : May-Jun 2018 : REBUILD YOUR LIFE

- Issue 113 : Mar–Apr 2018 : REMEMBRANCE

- Issue 112 : Jan-Feb 2018

- Issue 111 : Nov-Dec 2017

- Issue 110 : Sept-Oct 2017

- Issue 109 : July-Aug 2017

- Issue 108 : Apr-May 2017

- Issue 107 : Feb-Mar 2017

- Issue 106 : Dec 2016 - Jan 2017

- Issue 105 : Oct-Nov 2016

- Issue 104 : Aug-Sept 2016

- Issue 103 : May-June 2016

- Issue 102 : Mar-Apr 2016

- Issue 101 : Jan-Feb 2016

- Issue 100 : Nov-Dec 2015

- Issue 99 : Sept-Oct 2015

- Issue 98 : July-Aug 2015

- Issue 97 : May-Jun 2015

- Issue 96 : April 2015 [Mini Issue]

- Issue 95 : March 2015

- Issue 94 : February 2015

- Issue 93 : December 2014

- Issue 92 : November 2014

- Issue 91 : October 2014

- Issue 90 : September 2014

- Issue 89 : July 2014

- Issue 88 : June 2014

- Issue 87 : May 2014

- Issue 86 : April 2014

- Issue 85 : March 2014

- Issue 84 : February 2014

- Issue 83 : December 2013

- Issue 82 : November 2013

- Issue 81 : October 2013

- Issue 80 : September 2013

- Issue 79 : June 2013

- Issue 78 : 78

- Issue 77 : 77

- Issue 76 : 76

- Issue 75 : 75

- Issue 74 : 74

- Issue 73 : 73

- Issue 72 : 72

- Issue 71 : 71

- Issue 70 : 70

- Issue 69 : 69

- Issue 68 : 68

- Issue 67 : 67

- Issue 66 : 66

- Issue 65 : 65

- Issue 64 : 64

- Issue 63 : 63

- Issue 62 : 62

- Issue 61 : 61

- Issue 60 : 60

- Issue 59 : 59

- Issue 58 : 58

- Issue 57 : 57

- Issue 56 : 56

- Issue 56 : 56

- Issue 55 : 55

- Issue 54 : 54

- Issue 53 : 53

- Issue 52 : 52

- Issue 51 : 51

- Issue 50 : 50

- Issue 49 : 49

- Issue 48 : 48

- Issue 47 : 47

- Issue 46 : 46

- Issue 45 : 45

- Issue 44 : 44

- Issue 43 : 43

- Issue 42 : 42

- Issue 5 : 05

- Issue 4 : 04

- Issue 2 : 02

- Issue 1 : 01

- Issue 41 : 41

- Issue 40 : 40

- Issue 39 : 39

- Issue 38 : 38

- Issue 37 : 37

- Issue 36 : 36

- Issue 35 : 35

- Issue 34 : 34

- Issue 33 : 33

- Issue 10 : 10

- Issue 9 : 09

- Issue 6 : 06

- Issue 3 : 03

- Issue 32 : 32

- Issue 31 : 31

- Issue 30 : 30

- Issue 29 : 29

- Issue 11 : 11

- Issue 12 : 12

- Issue 13 : 13

- Issue 14 : 14

- Issue 15 : 15

- Issue 16 : 16

- Issue 17 : 17

- Issue 18 : 18

- Issue 19 : 19

- Issue 20 : 20

- Issue 21 : 21

- Issue 22 : 22

- Issue 23 : 23

- Issue 24 : 24

- Issue 25 : 25

- Issue 8 : 08

- Issue 7 : 07

- Issue 26 : 26

- Issue 27 : 27

- Issue 28 : 28

- Issue 1 : 01